5 Feb

CEO & Co-Founder of Hello Neighbour

London rent and demand stable moving into Autumn Rents steady year-on-year: London rents in September 2025 were 1% higher than September 2024, and 2% higher than September 2023. Overall, rents have held relatively...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Inner London Demand Outpaces Outer for the First Time in 3 Years London rents in August 2025 were 1.6% lower than August 2024, but still 3.6% higher than in August 2023. Overall, rents have held relatively steady,...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Rents fall 5% year on year despite increased tenant demand London rents in July 2025 are down 5.0% compared to July 2024 (matching the drop seen in June 2025 vs June 2024), and are 0.7% higher than in July 2023. Rents...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Both Tenant Demand and Rental Prices drop London rents in June 2025 are down 5.1% compared to June 2024, and 4.5% lower than in June 2023. Month-on-month, we’ve seen a decline of 1.5%, and a 1.9% drop when compared to...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Rental Prices and Demand Stay Flat London rents in May 2025 are up 1.1% compared to May 2024, and interestingly, the same level as May 2023. Although there has been a month-on-month decline of 2%, prices remain 1.3%...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Rental prices increase whilst demand stays flat London rents in April 2025 are up 10% compared to April 2024, and 9% higher than in April 2023. Although we’ve seen a month-on-month decline of 1.8%, prices are still up...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Demand stays low while prices increase in Mar 25 March has historically been a slower month for demand, and we have seen that trend continue this year, with 38 enquiries to view a property—16% lower than last year....

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Rental Prices drop in February 25 Demand has improved since January, moving from 38 to 46, however we have seen a significant drop in rental prices in Feb 25. London rents in February declined across all areas, falling...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

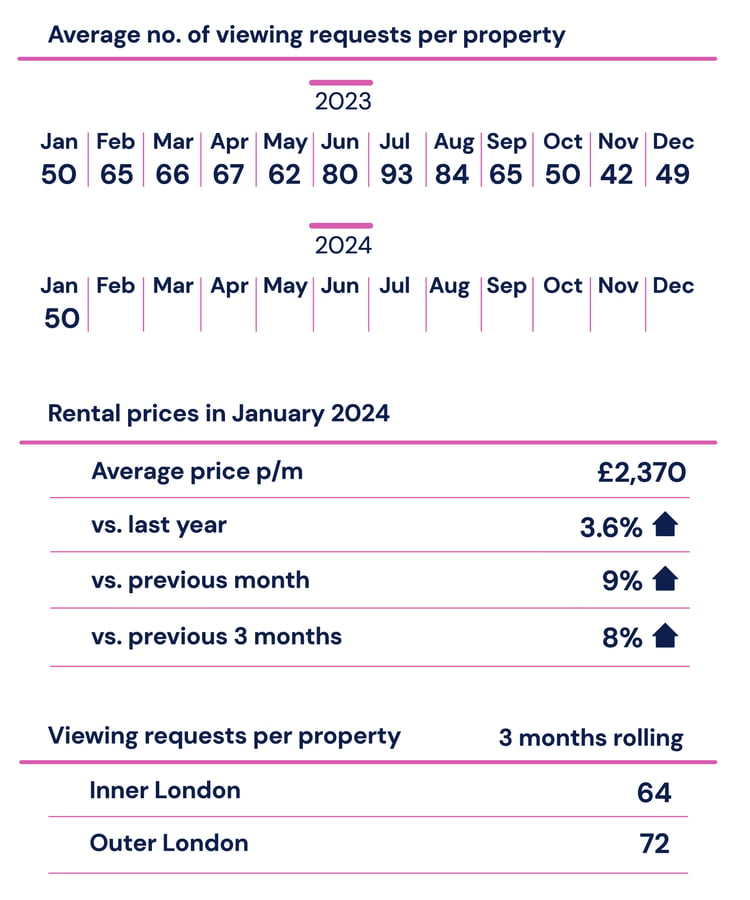

Lettings Market Continues to Cool After the usual slowdown in demand in December, January is picking up, but demand remains lower than in the previous two years, with 38 viewing requests per property in January 2025...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

In December 2024 we saw lower demand alongside higher rental prices. As the market typically slows during the colder months, a decline in viewing requests is expected at this time of year. We had 28 viewing requests per...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Lettings market similar to last year Nov We had 38 viewing requests per property in November, 10% lower than in Nov 23. London rents in October were down 0.8% from the previous month to £2,126 and down 5.1% compared to...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

4.1% Drop in rental prices vs Oct 23 We had 56 viewing requests per property in October, 10% higher than in Oct 23 London rents in October were down 4.9% from the previous month to £2,144 and down by 6.8% compared to...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

4.5% Drop in rental prices vs Sep 23 We had 62 viewing requests per property in September, in line with 65 last year Sep 23. London rents in September were down 4% from the previous month to £2,268 but up 3% compared to...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

38% increase in tenant demand during Aug 24 We had 72 viewing requests per property in August, a significant increase from the last three months; however, this is still down compared to last year’s 84 requests. London...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Rental prices increase over last 3 months We had 52 viewing requests per property in July, the same as in May and June 2024; however, this is significantly down from last year's 93 requests in July 2023. London Rents in...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Rental pricing decreased year on year in June We had 52 viewing requests per property in June, consistent with May; however, this is significantly down from last year's 80 requests in June 2023. Rents in June within...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

We continue to see signs of a cooling rental market We have seen 52 viewing requests per property in May, down from 62 in April, following a similar trend from last year of a quieter May before the summer months....

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Rents continue to fall We continue to see a fall in rentals within London, from an average of £2,219 last month to an average of £2,115 in April, a 5% drop, with 2-bed properties experiencing the most significant...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

As we flagged last month, we expected to see the growth in rental pricing slow. In fact we have seen a fall in London rental levels from an average of £2,261 last month to an average of £2,219 in March. This is a 2%...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Throughout February 2024, we saw much lower levels of viewing activity with 40 viewing requests per property, a 38% reduction from February 2023 and the lowest level we have seen in the last two years. In February 2024,...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

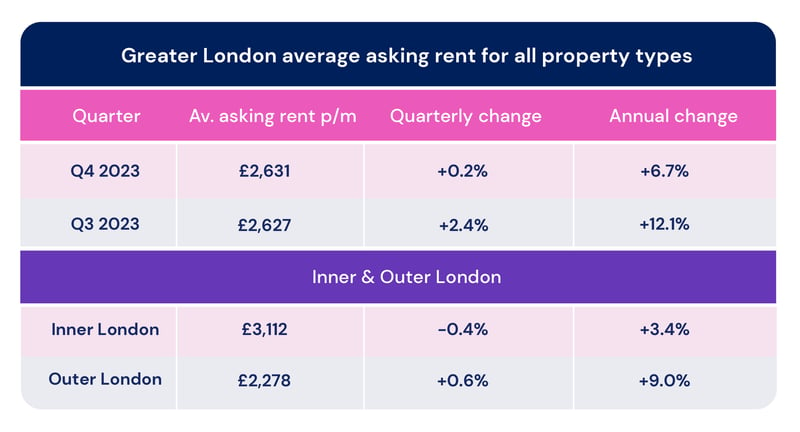

Throughout November we have seen a 25% drop in properties being priced 10%+ above market rate, with properties across London and Greater London being priced at lower levels. On average, rental prices have dropped by 4%...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

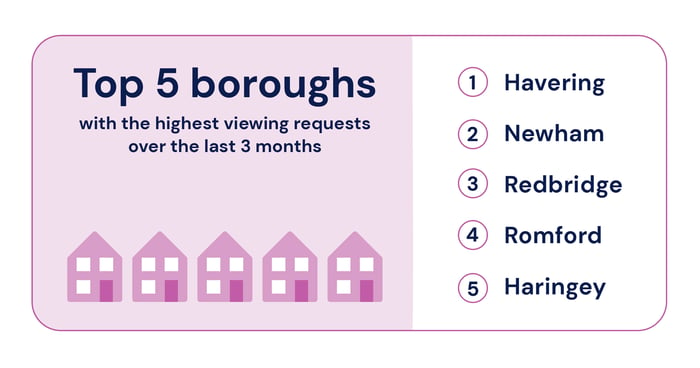

Demand is lower across all property types / number of bedrooms, however 3 and 4 bedroom rental properties are receiving the fewest amount of viewing enquiries. Despite a slow down in overall viewing requests, Greater...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

We've run the numbers and it's crazy but true – London's landlords are wasting up to £1bn a year paying unfair tenancy renewal fees, when renting their properties through high street letting agents. There are over one...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Compared to last month, £2,311 per month represents a 2% reduction in the average cost to rent a property in London and Greater London. That said, prices are still up by 3% compared to mid-2023. Over the last 3 month's,...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Throughout August, average rental prices per month were higher than the previous 3 months – driven by price increases on 3 bed properties of 12%. That said, there was an 8% drop in rental prices of 1 bed properties. We...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

We are seeing the highest number of viewing enquiries in Greater London areas such as Enfield, Redbridge, Romford and Kingston upon Thames. Despite this, month on month rental prices are down as tenants look further...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

This might suggest that despite the supply/demand imbalance, the extraordinary rent increases of the last period are coming to an end. The tenant location wish list is also reflecting acceptance of greater commute...

2 min read

5 Feb

CEO & Co-Founder of Hello Neighbour

Hosted at Old Billingsgate, London from 9am-5pm on the 4th July, Hello Neighbour are delighted to be exhibiting at the National Landlord Investment Show.

2 min read

COMMENT